TJ Agresti, JD, LLM, CAMFounder and President Archives

February 2021

|

Back to Blog

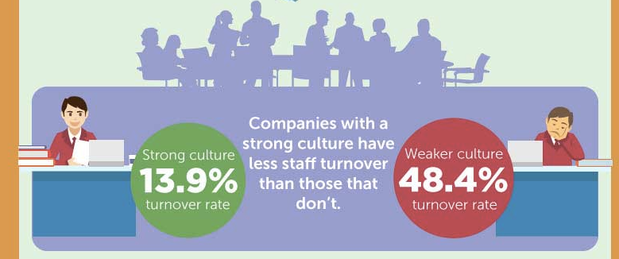

Communications | 8 Minute Read Corporate Culture Is an Asset Even small improvements in corporate culture can provide significant strategic advantages with measurable effect on the bottom line. Corporate culture encompasses all aspects of your organization’s environment and brand. It’s not just the perks of a breakroom with organic snacks or a ping pong table. It is the aggregate of the founders’ history, management’s influence, customers’ perceptions of brand promise and employees’ work experiences. Corporate culture is, in simplest terms, an imagined order which enables employees to cooperate and forge a better organization and customers to believe their desires align with a brand promise to fulfill them.[1] Corporate culture develops along the same paths that organizations take as they transition from their entrepreneurial stages of development up to a final professionally managed stage when it becomes necessary to consolidate and institutionalize the imagined order of shared beliefs. It is the last step that may seem intangible to many leaders but nevertheless is a real, measurable, and significant asset which must be taken advantage of. Metrics like employee engagement, job satisfaction, and brand perception can have measurable financial impacts on recruiting and retention performance, cross-functional project collaboration efficiencies and consumer brand loyalty. A culture transition is in progress whether management recognizes it or not as a company goes from the loose, free-spirited organization of its early days to a more disciplined one with a well-defined planning process, specific measurable goals, formal role descriptions and performance management systems. Organizations and Corporate Cultures Evolve Together Your company’s culture is transmitted by direct day-to-day contact between all members of the workforce regardless of position. Your first wave of employees came on board when the organization was relatively small and mostly entrepreneurial. According to the research of Eric Flamholtz and Yvonne Randle, encompassing thousands of organizations and their development, the first wave of employees probably came in when the organization had less than $1 million of revenue for manufacturing firms and less than $300,000 for service firms.[2] The imagined order of these core employees affects all subsequent waves as the company expands beyond the capacity of its social systems. Robin Dunbar, the famed British anthropologist, posits that the maximum “magic number” for a cohesive group size is 150 members.[3] In the business world, Dunbar’s number provides an important insight into why an organization’s sense of common purpose may weaken as its employee number grows without a defined culture and the communications systems to distribute, monitor and manage it. It is not your employees’ fault or management’s fault. It is the product of evolutionary psychology that informal socialization no longer functions to maintain corporate culture, by the time an organization reaches a workface level often required to attain $100 million in revenue for manufacturing firms and $33 million for service firms.[4] Larger groups of over 150 members may simply be unable to maintain the relationships necessary to share the binding force of common beliefs, values, interests or a shared sense of purpose. At this point, management must develop a succinctly defined corporate culture with a formal communications system to transmit, monitor, reinforce, and manage it. Where to Start The starting point is a culture audit which allows leadership to empirically assess the current state of its corporate culture, to collate and analyze all the data collected into a written report and then build a set of actionable and measurable strategies to create, improve, monitor and manage its corporate culture. The goal of the culture audit should be to build a culture driven organization that supports the sustainable performance of the business. Phase 1 - Assessment The first phase of a culture audit is the assessment stage. The assessment stage can be a narrowly focused audit with a specific target audience or a consolidated audit encompassing the entire workforce. Generally, some type of hybrid approach is used that begins with the consolidated approach then adds discrete audits of targeted groups or specific risks identified in the overall audit. The assessment stage generally includes a review of internal documents, the company intranet (if one exists), corporate policies and procedures, the company’s public facing web sites, news and media, social media platforms, customer feedback, promotional and marketing material. The object is to examine all the evidence and build a snapshot of current corporate culture as perceived by employees, management, and customers. Specific techniques may include:

Phase 2 - Analysis The next phase is to collate and analyze all the data, observations and information gathered into a written report shared with a cross-functional team assigned to the culture audit project. It is important to stress that culture is not merely a top-down exercise. It is a bi-lateral process that requires a robust communication system between even the newest staff members, the C-suite, and the board of directors if there is one. Management provides aspirational guidance on what they want the corporate culture to be, but the employees define what it is. The object is to affect a desired change and be able to sustain it which requires total buy-in by the workforce, at all levels, of the corporate culture. The initial report should provide a balance of both positive and negative aspects of the current state of the corporate culture organized along themes aligned with your company’s organizational structure. Some commons themes to help organize the information may be:

Phase 3 - Audit Report and Recommendations

Culture Handbook The distillation of the culture audit also provides the content necessary to create a culture handbook. This guiding document will become the living content hub that evolves as your corporate cultures evolves. It is both an internal document that should find a prominent home on the company intranet and an external document that should be integrated into an employee recruiting and retention program as well as external communications channels. Customers should know, just like prospective and current employees, what makes your company special, so they choose to be a part of it. The content of your culture handbook will align closely with the themes used to organize the culture audit. The biggest difference will be the format. The culture audit will be an analytical document focused on objectives and metrics while the culture handbook will be a more proud promotion of your brand focused on creating a desire to belong to it. In a 2016 interview for the Greymatter podcast, Reed Hastings, CEO of Netflix said, “[a culture handbook] is a bill of rights for employees; here is a set of things that we, the company, want and aspire to operate by, and, if we don’t, you can call us out on it and we will either fic the articulation-because it’s too easy to misunderstand-or live up to what we want to. So, in some ways, it’s aspirational. By putting it in writing […] it allows all the people in the company to collaborate on it and suggest improvements.” Change Management Keep in mind, during a corporate culture transition, that some employee groups may have been in place with strong entrenched beliefs from the early stages of the organization. Embedding a new corporate culture and new operating systems is a type of trauma for many employees comfortable in how things currently work. A change management plan that addresses the normal fear associated with change must be a consideration with extra time and effort allocated to avoid resistance and overcome the potential for an exodus of your longest serving and maybe most loyal employees. According to Heather Boushey and Sarah Glynn who analyzed 30 case studies from the 11 most relevant research papers in their 2012 study for the Center for American Progress [5], the average costs to replace an employee are:

Human resource managers grasp the cost of employee turnover. That said, performance management systems usually accompany the corporate culture transition to a professionally managed organization. The transition often creates accountability which may not have existed before. You may find that some employees simply are not as productive or are, in fact, counterproductive to the performance of the organization. Bottom Line After all, that is the bottom line, the performance of your organization that you are responsible for in your leadership capacity. The sustainable strategic advantage that is in your control and that cannot be duplicated is your corporate culture. According to a 2015 article in Harvard Business Review, a culture driven organization achieves significantly higher organizational effectiveness, increased productivity, employee engagement, financial performance, and customer satisfaction. Your culture audit and corporate culture program can boost employee commitment and engagement while fostering collaboration, communication, and teamwork which translates to a positive employee experience, efficiencies in project completion, more customer brand loyalty, improved recruiting and retention and an improved bottom line year after year. You must ask yourself, “What type of leader am I?”

Now is the time to maximize the one strategic advantage you have complete control over. Start with a culture audit then create a culture handbook, allocate the necessary resources to implement, monitor and maintain it, and develop the necessary operational communications systems that allow it to thrive. [1] Yuval Noah Harari, Sapiens-A Brief History of Mankind (New York: harper Perennial, 2015), 114 [2] Eric G. Flamholtz and Yvonne Randle, Growing Pains: Building Sustainably Successful Organizations (New Delhi: Wiley, 2016, 5th Edition), 48 [3] Robin Dunbar, How many Friends Does One Person Need? Dunbar’s Number and Other Evolutionary Quirks (London: Faber & Faber, 2010) [4] Flamholtz and Randle, growing Pains, 48 [5] Heather Boushey and Sarah Jane Glynn, There are Significant Business Costs to Replacing Employees (Washington, D.C., Center For American Progress, 2012) https://www.americanprogress.org/wp-content/uploads/2012/11/CostofTurnover.pdf About T.J. Agresti Mr. Agresti is the Founder and President of Critical Mission Consulting, LLC and a recognized entrepreneurial executive who employs corporate culture driven professional management practices, cross-functional strategic leadership and full stack team execution that deliver on P&L driven KPIs. He founded Critical Mission Consulting to provide organizations go to market corporate communications strategies; corporate culture programs; diversity, equity and inclusion initiatives; employee recruiting and retention programs; company intranets; business development and marketing plans; strategic financial plans; and project management platforms to support the achievement of each company's mission and vision in the delivery of its brand promise. To contact him or learn more about Critical Mission Consulting, LLC visit https://www.criticalmissionconsulting.com/

0 Comments

Read More

Back to Blog

Finance | 3 Minute Read Organizations that move money through the international monetary system know the inherent risks associated with currency value fluctuations, payment delays and the associated losses on accounts payable and receivable. They also suffer through the daily difficulties of payment scheduling, currency management, currency risk, payment reconciliation and reporting for both accounting and legal requirements. Many corporate executives are hard-wired to default to their bank for international payables and receivables. However, traditional banks not only charge a high rate, they are not designed to mitigate the risks of currency value fluctuations or handle exchanges in nearly every country. An integrated global payment solution that mitigates these costs and risks must be central to the business plan of every organization from start-ups to large publicly traded multinationals. The global payment solution must drive down payment transactions costs, provide instant settlement in local currencies, hedge currency risk and convert an expense into a revenue generation event. Critical Mission Consulting approaches risk mitigation as a means of unlocking venture value and unleashing revenue potential. To accomplish our goals, we formed a strategic partnership with AFEX Global Payment Solutions. AFEX is a global payment industry leader with offices around the globe and a financial technology solution that allows complete integration with a company’s existing accounting and legal systems. AFEX has a payment solution for our clients in all sectors, including but not limited to, import/export, claims management, education, corporate service providers, freight forwarders, funds and wealth managers, NGOs and charities, real estate, travel and entertainment. Critical Mission Consulting, powered by AFEX, is not a traditional bank. Our technology delivers more capabilities than conventional banks with superior, high-touch, customer service. Critical Mission Consulting, powered by AFEX, payment solutions include:

The Critical Mission Solution, powered by AFEX, fintech solution is plug and play (no costly integration or proprietary software required). Their expertise streamlines integration into your current system, creating opportunities to scale via a suite of API’s or batch processing. Alternatively, payments can be managed via AFEX’s secure online user interface. Speed, accuracy and value protection is the oil that keeps accounts payable and receivable moving smoothly. The strategy of CMC is to identify every available device to drive down risk and costs and drive up value for every venture. The launch of our integrated global payment system is precisely the type of risk mitigation tool our clients demanded, and we delivered. To learn more visit our Global Payments Solutions visit our landing page at CriticalMissionConsulting/AFEX. For more information or to schedule your no cost no obligation international payments analysis, contact an advisor Request AFEX Info. About AFEX

AFEX is a leading global payments specialist, offering tailored solutions since 1979. We serve more than 35,000 clients from offices across EMEA, APAC and the Americas, facilitating payments in over 100 currencies to 180 countries every day. Our unmatched global payments infrastructure provides extensive payment rails, including same-day and real-time payments. By combining forward-facing technologies, including our customizable, flexible APIs, with end-to-end support and personalized risk management strategies, AFEX helps clients and partners around the world manage global payments efficiently and securely. About CMC CMC is a recognized business strategy leader providing business management and boutique risk mitigation tools to build organizational value since 2013. From new venture start-ups to established publicly traded businesses, CMC employs insurance, currency, and information technology solutions to enhance valuation, shift risk and strengthen credit for bond issuances and capital raises. Our team, comprised of entrepreneurs, tax & legal advisors, and C-suite executives, with decades of experience on “both sides of the table,” enhance strengths and identify risks to position clients for financial success.

Back to Blog

Get Noticed and Get Funded9/12/2020 Get Funded and On Better Terms With Customized Risk Guarantee Coverages Finance | 5 Min Read You’ve developed a product or service, you have the right team in place and have sales data to prove there is a ready market. You’re ready to start -up or scale up and need capital. You decide to go after private equity or a private loan. You want to get funded. You want great terms based on a high valuation for your company. I’ve taken multiple companies from start-up through a series of private equity rounds and credit facilities all the way to exit. In every case, there was a focal point that distinguished our pitch from every other company to get us noticed and get us funded. The story you tell investors must be captivating, credible and memorable to have any chance of convincing an investment committee that your company has the potential to score a multiple on their investment. So today I am going to share five steps that will get you noticed and get you funded on better terms and better valuation using risk guarantee insurance coverages. HOW TO GET NOTICED |

| The following expenses incurred or paid by the borrower during the 24 weeks following loan origination are eligible for forgiveness: Payroll Expenses:

Non-Payroll Expenses:

Note: For an independent contractor or sole proprietor, you must have claimed or be entitled to claim a deduction for these expenses on your 2019 Form 1040 Schedule C in order to claim them as expenses eligible for PPP loan forgiveness in 2020. |

- The time period to use funds is extended to 24 weeks from 8 weeks.

- The deadline to rehire workers is pushed back to December 31, 2020 (instead of June 30, 2020). The loan amount and salaries are still calculated using the original method.

- Additional exceptions have been added to the rehire requirements. If an employer can’t hire all employees back, the business can still receive forgiveness if it:

|

- The repayment term is extended to 5 years for new loans approved on or after June 5, 2020. In the event loans or portions of them are not forgiven, a business will now have five years at 1% interest to repay the loan. Further, the first payment will be deferred for six months after the SBA makes a determination on forgiveness.

- If you received a loan before June 5, contact your lender to see if you are able to extend your repayment term.

Filling Out the PPP

Loan Forgiveness Form

The following steps correspond to the PPP Loan Forgiveness Form.

Step 1: Determine total payroll costs in the 8 or 24 week covered period

Note: Ask your accountant, tax preparer or loan advisor about the wage limit of $15,385.00 for each employee

Add the total cash wages paid to all employees(limited to $15,385.00) and then add in:

a. Employer pension contribution

b. Employer health insurance premiums paid

c. Employer paid state and local taxes assessed on compensation

Step 2: Take the total from Step 1 and divide by .60

This determines the maximum amount of the PPP loan that will be forgiven.

Compare the amount of hte PPP loan received with the maximum amount that will be forgiven.

If the maximum amount under the 60% test is equal to or greater than the PPP loan, there is no reduction.

If the maximum amount under hte 60% test is less than the PPP loan, the difference will not be forgiven and will have to be repaid.

Step 3: determine eligible non-payroll costs

Add the total rent, interest, and utilities paid in the 8 or 24 week covered period

take the maximum a mount of hte PPP loan that can be forgiven, From Step 2, and multiply that by .40.

Compare the total of rent, interest, and utilities that were paid in the 8 or 24 week period to determine if the total is at least 40% of hte maximum PPP loan amount that is eligible for forgiveness.

If the total rent, interest, and utilities exceeds 40%, limit the amount that will be transferred to the form to 40%. This is the Step 3 total.

If the total rent, interest and utilities is less than 40% of hte maximum PPP loan amount that is eligible for forgiveness, enter the total on the form. This will increase the amount of hte PPP loan that will have to be repaid. This is the Step 3 total

Step: 4 Add the amounts determines in Step 2 and Step 3.

This is the total amount for Step 4:

Step 2 max amount of PPP loan eligible for forgiveness

Plus

Step 3 Non-payroll costs maxed at 40%

Equals

Steps 4 Total

Step 5: Determine if there was a salary reduction

a. For each employee, determine if their salary or wages were reduced by more than 40% during the covered period as compared to the salary or wages that were received during hte period of January 1, 2020 to March 31, 2020.

b. Do not include any employee whose wages were reduced due to a reduction in full-time employment. If an employee previously worked as a full-time employee and their hours were reduced by half, the reduction of salary or wages by more than 25% does not apply. (This reduction is taken into account in Step 6.)

c. For each employee, take 75% of their regular wages in the period of January 1, 2020 to March 31, 2020, before the reduction in wages, and then subtract the wages paid in the covered period. This is the amount of reduction in wages for that employee.

d. Convert the amount of reduction in wages calculated in c. above to the 8 or 24 week covered period. For example, if the employee is paid monthly, multiply the monthly reduction by 12 to get the annual amount, divide by 52 to get the weekly amount and then multiply by 8 or 24. If the employee is paid weekly, simply multiply the weekly reduction by 8 or 24.

e. But there is a savings clause. There is no reduction in wages if the employee's average salary or wage amount paid between February 15, 2020 and April 26, 2020 is less than the wages or salary paid on February 15, 2020 and the reduction is salary or wages in the covered period is restored to the wages or salary amount as of June 30, 2020.

f. Add up the reductions for all employees determined in d. above for whom the savings clause in e. above does not apply.

g. The Step 5 amount is the Step 4 total less f., the total reduction for all employees.

Step 6. Determine if there was a reduction in full-time employees

a. Determine if you meet the savings clause on June 30. Compare full-time employees between February 15 and April 26, 2020 to the full-time employees on February 15, 2020. If the number of full time employees is restored by June 30, 2020, there is no reduction in full time employees and hte PPP loan amount eligible for forgiveness is hte amount determine in Step 5.

b. If you don't meet the safe harbor in a. above, determine the average full-time employees in the covered period and divide that by the average full-time employees in either the period of January 1 to February 29 or February 15 to June 30.

Then multiple that by the amount determined in Step 5. This is the amount of the PPP loan that is eligible to be forgiven.

Step 1: Determine total payroll costs in the 8 or 24 week covered period

Note: Ask your accountant, tax preparer or loan advisor about the wage limit of $15,385.00 for each employee

Add the total cash wages paid to all employees(limited to $15,385.00) and then add in:

a. Employer pension contribution

b. Employer health insurance premiums paid

c. Employer paid state and local taxes assessed on compensation

Step 2: Take the total from Step 1 and divide by .60

This determines the maximum amount of the PPP loan that will be forgiven.

Compare the amount of hte PPP loan received with the maximum amount that will be forgiven.

If the maximum amount under the 60% test is equal to or greater than the PPP loan, there is no reduction.

If the maximum amount under hte 60% test is less than the PPP loan, the difference will not be forgiven and will have to be repaid.

Step 3: determine eligible non-payroll costs

Add the total rent, interest, and utilities paid in the 8 or 24 week covered period

take the maximum a mount of hte PPP loan that can be forgiven, From Step 2, and multiply that by .40.

Compare the total of rent, interest, and utilities that were paid in the 8 or 24 week period to determine if the total is at least 40% of hte maximum PPP loan amount that is eligible for forgiveness.

If the total rent, interest, and utilities exceeds 40%, limit the amount that will be transferred to the form to 40%. This is the Step 3 total.

If the total rent, interest and utilities is less than 40% of hte maximum PPP loan amount that is eligible for forgiveness, enter the total on the form. This will increase the amount of hte PPP loan that will have to be repaid. This is the Step 3 total

Step: 4 Add the amounts determines in Step 2 and Step 3.

This is the total amount for Step 4:

Step 2 max amount of PPP loan eligible for forgiveness

Plus

Step 3 Non-payroll costs maxed at 40%

Equals

Steps 4 Total

Step 5: Determine if there was a salary reduction

a. For each employee, determine if their salary or wages were reduced by more than 40% during the covered period as compared to the salary or wages that were received during hte period of January 1, 2020 to March 31, 2020.

b. Do not include any employee whose wages were reduced due to a reduction in full-time employment. If an employee previously worked as a full-time employee and their hours were reduced by half, the reduction of salary or wages by more than 25% does not apply. (This reduction is taken into account in Step 6.)

c. For each employee, take 75% of their regular wages in the period of January 1, 2020 to March 31, 2020, before the reduction in wages, and then subtract the wages paid in the covered period. This is the amount of reduction in wages for that employee.

d. Convert the amount of reduction in wages calculated in c. above to the 8 or 24 week covered period. For example, if the employee is paid monthly, multiply the monthly reduction by 12 to get the annual amount, divide by 52 to get the weekly amount and then multiply by 8 or 24. If the employee is paid weekly, simply multiply the weekly reduction by 8 or 24.

e. But there is a savings clause. There is no reduction in wages if the employee's average salary or wage amount paid between February 15, 2020 and April 26, 2020 is less than the wages or salary paid on February 15, 2020 and the reduction is salary or wages in the covered period is restored to the wages or salary amount as of June 30, 2020.

f. Add up the reductions for all employees determined in d. above for whom the savings clause in e. above does not apply.

g. The Step 5 amount is the Step 4 total less f., the total reduction for all employees.

Step 6. Determine if there was a reduction in full-time employees

a. Determine if you meet the savings clause on June 30. Compare full-time employees between February 15 and April 26, 2020 to the full-time employees on February 15, 2020. If the number of full time employees is restored by June 30, 2020, there is no reduction in full time employees and hte PPP loan amount eligible for forgiveness is hte amount determine in Step 5.

b. If you don't meet the safe harbor in a. above, determine the average full-time employees in the covered period and divide that by the average full-time employees in either the period of January 1 to February 29 or February 15 to June 30.

Then multiple that by the amount determined in Step 5. This is the amount of the PPP loan that is eligible to be forgiven.

Simple? - Not So Much

We are helping clients navigate the uncertainty due to ever changing rules surrounding hte PPP loan program. Our accounting staff is prepared to answer your questions about your PPP loan and assist you in the submission of your forgiveness application.

Back to Blog

Read More

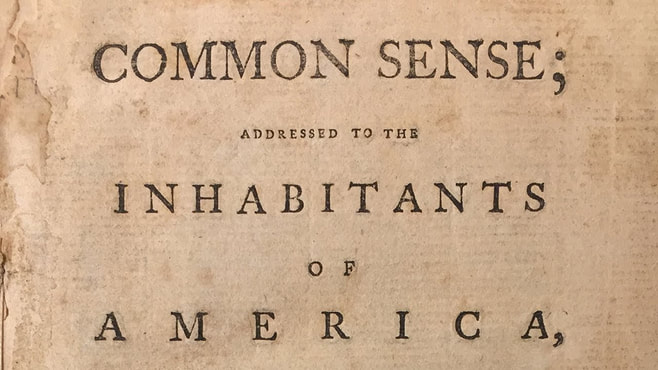

Maybe Common Sense Is Not Dead

6/4/2020

Business Finance | 3 Min read

Bi-Partisanship Is Not Dead Yet

In a stunning display of bi-partisanship, the Senate approved the House's Bill yesterday for a PPP Loan Program revision, called the Paycheck Protection Flexibility Act, which provides more flexibility to business and should ease businesses' burdens and concerns about utilizing the program. The Bill will now go to President Donald Trump, who is expected to sign it.

The revisions represent common sense fixes to a well intentioned business relief program that has been over burdened by confusion and recently underutilized by the very businesses it was intended to help through the crisis.

The revisions represent common sense fixes to a well intentioned business relief program that has been over burdened by confusion and recently underutilized by the very businesses it was intended to help through the crisis.

Summary Of PPP Loan Program Revisions

The Journal of Accountancy provides and excellent summary of the revisions compiled by AICPA:

- Current PPP borrowers can choose to extend the eight-week period to 24 weeks, or they can keep the original eight-week period. New PPP borrowers will have a 24-week covered period, but the covered period can’t extend beyond Dec. 31, 2020. This flexibility is designed to make it easier for more borrowers to reach full, or almost full, forgiveness.

- Under the language in the House bill, the payroll expenditure requirement drops to 60% from 75% but is now a cliff, meaning that borrowers must spend at least 60% on payroll or none of the loan will be forgiven. Currently, a borrower is required to reduce the amount eligible for forgiveness if less than 75% of eligible funds are used for payroll costs, but forgiveness isn’t eliminated if the 75% threshold isn’t met. Rep. Chip Roy (Texas), who co-sponsored the bill in the House, said in a House speech that the bill intended the sliding scale to remain in effect at 60%. Senators Marco Rubio and Susan Collins indicated that technical tweaks could be made to the bill to restore the sliding scale.

- Borrowers can use the 24-week period to restore their workforce levels and wages to the pre-pandemic levels required for full forgiveness. This must be done by Dec. 31, a change from the previous deadline of June 30.

- The legislation includes two new exceptions allowing borrowers to achieve full PPP loan forgiveness even if they don’t fully restore their workforce. Previous guidance already allowed borrowers to exclude from those calculations employees who turned down good faith offers to be rehired at the same hours and wages as before the pandemic. The new bill allows borrowers to adjust because they could not find qualified employees or were unable to restore business operations to Feb. 15, 2020, levels due to COVID-19 related operating restrictions.

- Borrowers now have five years to repay the loan instead of two. The interest rate remains at 1%.

- The bill allows businesses that took a PPP loan to also delay payment of their payroll taxes, which was prohibited under the CARES Act.

PPP Loan Program Background

The PPP Loan Program launched in early April with $349 billion in funding. I previously commented on the the initial demand exhausting available funds in less than two weeks as well Congress provided an additional $310 billion in funding in an April 21 vote. I also wrote about waning demand from business due to concerns about obtaining of loan forgiveness under the program’s rules advising our clients to wait and see how Congress addressed the uncertainty.

When dealing with the government, especially in this current atmosphere of dysfunction, a wait and see approach sometimes pays off. The current revisions from a common sense bi-partisan bill might actually fulfill the original intent of hte PPP Loan Program and help many struggling businesses survive the current crisis and keep paying their employees. A little hope is something we could all use right now.

When dealing with the government, especially in this current atmosphere of dysfunction, a wait and see approach sometimes pays off. The current revisions from a common sense bi-partisan bill might actually fulfill the original intent of hte PPP Loan Program and help many struggling businesses survive the current crisis and keep paying their employees. A little hope is something we could all use right now.

Back to Blog

Read More

Cash Is King But Don't Be A Sucker

5/28/2020

Business Finance | 3 Min Read

Warren Buffett famously said, “Be fearful when others are greedy, and be greedy only when others are fearful.” After the Federal government's rescue of the economy avoided a complete collapse of the capital markets during the last Great Recession there was an abundance of greedy investor capital looking for devalued businesses to invest in or acquire outright. New research from the JP Morgan Chase Institute finds that many small businesses are living month to month, and the median small business has only enough cash in the bank to last 27 days without additional funds. "It is well known that small businesses are a critical driver of economic growth, but the consistency of their growth is in question if they're living month to month," Diana Farrell, president and CEO of the JP Morgan Chase Institute, said in a statement. Now, it's becoming apparent that the amount of cash sitting on the sidelines waiting for the right moment is even larger than the last time. The targets will be your stressed business that may be running out of cash.

While we still do not know the depths our economy may go to during this "Great Social Distancing" we do know that the government will do whatever is necessary to avoid depression like economics and provide an opportunity for a swift recovery. At least that is the intent otherwise 22 million unemployed Americans and counting don't go back to work. We end up with 10% plus persistent unemployment, an enormous national debt and a stagnated economy creating the real possibility of sovereign debt default or a currency devaluation event (but this is another topic).

Whether the current stimulus package will succeed or not is yet to be seen but there is enough support for a vaccine within a year and therapeutic treatment before that to create optimism for a faster than normal recovery from the depths of the current crisis. Now is the time to engineer your financial plan for the recovery using income models based on the best case of rapid recovery, the worst case of extended recovery and something in the middle that resembles a start stop approach to the recovery of economic activity. The intermittent activity model accounts for the likelihood of waves of social distancing that might occur until a widely available vaccine or therapeutic drug is available.

A key part of the financial plan is a supportable stock valuation model that will be the basis for any negotiation with a private investor. Valuation is the determining factor of percentage ownership you have to give up to get the capital you need to support your recovery business model. Additionally, private investors want a clear picture of how they get their capital back with a multiple of yield over a given period of time. You must have a viable exit strategy built into your financial model which tracks the valuation adjustment over time as your business recovers and grows. The realization event for the new valuation may be a merger, sale or IPO.

Private capital is available to rescue your company and support a relaunch but don't be taken advantage of by a lack of preparation.

Questions to Ask

While we still do not know the depths our economy may go to during this "Great Social Distancing" we do know that the government will do whatever is necessary to avoid depression like economics and provide an opportunity for a swift recovery. At least that is the intent otherwise 22 million unemployed Americans and counting don't go back to work. We end up with 10% plus persistent unemployment, an enormous national debt and a stagnated economy creating the real possibility of sovereign debt default or a currency devaluation event (but this is another topic).

Whether the current stimulus package will succeed or not is yet to be seen but there is enough support for a vaccine within a year and therapeutic treatment before that to create optimism for a faster than normal recovery from the depths of the current crisis. Now is the time to engineer your financial plan for the recovery using income models based on the best case of rapid recovery, the worst case of extended recovery and something in the middle that resembles a start stop approach to the recovery of economic activity. The intermittent activity model accounts for the likelihood of waves of social distancing that might occur until a widely available vaccine or therapeutic drug is available.

A key part of the financial plan is a supportable stock valuation model that will be the basis for any negotiation with a private investor. Valuation is the determining factor of percentage ownership you have to give up to get the capital you need to support your recovery business model. Additionally, private investors want a clear picture of how they get their capital back with a multiple of yield over a given period of time. You must have a viable exit strategy built into your financial model which tracks the valuation adjustment over time as your business recovers and grows. The realization event for the new valuation may be a merger, sale or IPO.

Private capital is available to rescue your company and support a relaunch but don't be taken advantage of by a lack of preparation.

Questions to Ask

- How long can I last with current cash on hand?

- How much capital do I need to restart my operation?

- What is my business worth?

- What is the exit plan?

Back to Blog

Read More

Business Finance | 5 Min Read

Uncertainty Abounds

Over the past several weeks, the SBA's and Treasury's uneven administration and rules guidance of the PPP, created a large amount of uncertainty for many businesses who already applied for and obtained their loan proceeds. A series of rule changes, guidance and press releases by the SBA and Treasury have many businesses giving back their PPP Loan proceeds out of fear they no longer qualify and may be subject to criminal prosecution. Many other businesses are reluctant to even apply for PPP loans due to the perceived risks.

Borrowers Frustrated

Borrowers report requirements are challenging to either comply with or to meet in order to qualify for maximum loan forgiveness. Nearly half they say using the loan within the eight-week window is somewhat or very difficult, and the same percentage finds it very or somewhat difficult to get employee headcount back to pre-crisis levels. New guidance issued May 13, meant to relieve PPP loan recipients confusion and anxiety, is being met with broad relief from PPP participants and potential applicants who may be sitting on the fence, and is available from the SBA at PAYCHECK PROTECTION PROGRAM LOANS Frequently Asked Questions (FAQs) and from the US Treasury website at PAYCHECK PROTECTION PROGRAM LOANS.

Treasury/SBA Update

There are a 47 questions and answers providing updates and clarifications from the SBA. The top changes with the greatest potential impact are:

Owner Questions

Business owners have questions about how to spend the funds and what they can spend the loan on as many of the terms and conditions are broad and unclear when applied to specific business operations. "Nearly three-fourths of small business borrowers find the terms and conditions of the PPP loan difficult to understand with 22% finding them very difficult,” the SBA report said. While many PPP participants are relieved about the guidance, there is still significant apprehension that additional changes may occur resulting in unexpected non-compliance by businesses who are attempting to act in good faith. As a result, many advisors, including Critical Mission Consulting, Inc., a Denver business consulting firm, are counseling a conservative wait and see approach, when possible.

What To Do

Critical Mission Consulting, Inc. President, T.J. Agresti, sad about their business clients, "there is nothing that requires businesses to spend their PPP proceeds immediately. We are telling businesses, especially those planning to request loan forgiveness, to hold off on spending their loan proceeds and to wait as long as possible within the 8 week loan forgiveness period."

Main Street advocates are eager to see lawmakers move ahead with proposed changes when the House votes on the Paycheck Protection Flexibility Act, which makes tweaks to the PPP, including extending the covered-period window of eight weeks and the split on what the funds can be used on. The proposed changes have bipartisan support and could encourage more business owners to apply for aid. “No doubt, these key changes will make the program work more effectively for small businesses and their employees.

These changes also align with conditions on the ground,” said Karen Kerrigan, president and CEO of the Small Business & Entrepreneurship Council. “PPP needs to be structured more flexibly at this point given the very different stay-at-home and shutdown orders in the states, and the very different plans and phases for re-openings, which will drive demand,” she said. “A one-size-fits-all PPP program does not work — things have changed tremendously since the design of the program in early to mid-March.”

However, some business have no choice but to spend their PPP loan proceeds to keep their business afloat. "We are advising our clients to spend 75% on payroll qualifying expenses but if its between losing your business or having to repay the PPP loan, then do what needs to be done and save your business," said Mr. Agresti. These business have no choice but to ride out the uncertainty surrounding guidance of the PPP and hope they are compliant with the final rules.

There is momentum to make the program more flexible and the addition of the safe harbor should cover the vast majority of borrowers. Businesses who accepted under $2 million covers over 98% of Phase One loans and over 99% of Phase Two loans according to the SBA. The risks associated with taking a PPP loan may now be acceptable for many more businesses who were in a holding pattern waiting to spend their loan proceeds or apply for a new loan.

Money Still Available

There is still an opportunity to apply for and receive forgivable loans from PPP. The program has $126.5 billion in funding left, according to the Small Business Administration. A careful review, with advisors, of the application requirements, and the rules on how to obtain forgiveness, if that is the goal, are a must. Forgiveness is available if you use 75% of the loan for payroll but even if you don't want forgiveness, the loan is still inexpensive capital with a 2 year term and an interest rate of 1%.

For more news and reporting on the coronavirus and how businesses can handle challenges related to the Paycheck Protection Program and the pandemic, visit T.J.'s blog page or go to the Critical Mission Consulting website Coronavirus resources page.

Over the past several weeks, the SBA's and Treasury's uneven administration and rules guidance of the PPP, created a large amount of uncertainty for many businesses who already applied for and obtained their loan proceeds. A series of rule changes, guidance and press releases by the SBA and Treasury have many businesses giving back their PPP Loan proceeds out of fear they no longer qualify and may be subject to criminal prosecution. Many other businesses are reluctant to even apply for PPP loans due to the perceived risks.

Borrowers Frustrated

Borrowers report requirements are challenging to either comply with or to meet in order to qualify for maximum loan forgiveness. Nearly half they say using the loan within the eight-week window is somewhat or very difficult, and the same percentage finds it very or somewhat difficult to get employee headcount back to pre-crisis levels. New guidance issued May 13, meant to relieve PPP loan recipients confusion and anxiety, is being met with broad relief from PPP participants and potential applicants who may be sitting on the fence, and is available from the SBA at PAYCHECK PROTECTION PROGRAM LOANS Frequently Asked Questions (FAQs) and from the US Treasury website at PAYCHECK PROTECTION PROGRAM LOANS.

Treasury/SBA Update

There are a 47 questions and answers providing updates and clarifications from the SBA. The top changes with the greatest potential impact are:

- the expansion of the program allowing lenders to increase PPP loans to partnerships to include appropriate amounts to cover partner compensation.

- the allowance for seasonal employers to calculate their maximum loan amount using the alternative criterion issued April 28.

- the extension of the safe harbor for returning PPP loans from May 14 to May 18 that gives an opportunity for borrowers that received PPP loans to return them if they are not able to make a good-faith certification of the necessity of their loan requests .

- the SBA issued guidance for businesses who, together with their affiliates, accepted PPP funds of less than $2 million, will be assumed to have performed the required certification concerning the necessity of their loan requests in good faith.

Owner Questions

Business owners have questions about how to spend the funds and what they can spend the loan on as many of the terms and conditions are broad and unclear when applied to specific business operations. "Nearly three-fourths of small business borrowers find the terms and conditions of the PPP loan difficult to understand with 22% finding them very difficult,” the SBA report said. While many PPP participants are relieved about the guidance, there is still significant apprehension that additional changes may occur resulting in unexpected non-compliance by businesses who are attempting to act in good faith. As a result, many advisors, including Critical Mission Consulting, Inc., a Denver business consulting firm, are counseling a conservative wait and see approach, when possible.

What To Do

Critical Mission Consulting, Inc. President, T.J. Agresti, sad about their business clients, "there is nothing that requires businesses to spend their PPP proceeds immediately. We are telling businesses, especially those planning to request loan forgiveness, to hold off on spending their loan proceeds and to wait as long as possible within the 8 week loan forgiveness period."

Main Street advocates are eager to see lawmakers move ahead with proposed changes when the House votes on the Paycheck Protection Flexibility Act, which makes tweaks to the PPP, including extending the covered-period window of eight weeks and the split on what the funds can be used on. The proposed changes have bipartisan support and could encourage more business owners to apply for aid. “No doubt, these key changes will make the program work more effectively for small businesses and their employees.

These changes also align with conditions on the ground,” said Karen Kerrigan, president and CEO of the Small Business & Entrepreneurship Council. “PPP needs to be structured more flexibly at this point given the very different stay-at-home and shutdown orders in the states, and the very different plans and phases for re-openings, which will drive demand,” she said. “A one-size-fits-all PPP program does not work — things have changed tremendously since the design of the program in early to mid-March.”

However, some business have no choice but to spend their PPP loan proceeds to keep their business afloat. "We are advising our clients to spend 75% on payroll qualifying expenses but if its between losing your business or having to repay the PPP loan, then do what needs to be done and save your business," said Mr. Agresti. These business have no choice but to ride out the uncertainty surrounding guidance of the PPP and hope they are compliant with the final rules.

There is momentum to make the program more flexible and the addition of the safe harbor should cover the vast majority of borrowers. Businesses who accepted under $2 million covers over 98% of Phase One loans and over 99% of Phase Two loans according to the SBA. The risks associated with taking a PPP loan may now be acceptable for many more businesses who were in a holding pattern waiting to spend their loan proceeds or apply for a new loan.

Money Still Available

There is still an opportunity to apply for and receive forgivable loans from PPP. The program has $126.5 billion in funding left, according to the Small Business Administration. A careful review, with advisors, of the application requirements, and the rules on how to obtain forgiveness, if that is the goal, are a must. Forgiveness is available if you use 75% of the loan for payroll but even if you don't want forgiveness, the loan is still inexpensive capital with a 2 year term and an interest rate of 1%.

For more news and reporting on the coronavirus and how businesses can handle challenges related to the Paycheck Protection Program and the pandemic, visit T.J.'s blog page or go to the Critical Mission Consulting website Coronavirus resources page.

Back to Blog

Read More

Business Finance | 9 MIN Read

Loan Repayment Insurance Is The Secret

The ability of a business to borrow money will make the difference between surviving or failing during the current crisis and being ready to thrive when the economy recovers. Many business leaders are asking their advisors for guidance on how to improve their odds of successfully obtaining a loan. At the same time, lenders are looking at the economic landscape trying to navigate a level of unprecedented uncertainty which is creating barriers to lending. A new lending product has emerged to provide both lender and borrower assurance that a loan will be repaid during these uncertain times. It’s called Performance Guarantee Insurance.

Performance Guarantee Insurance is coverage that guarantees the borrower's repayment of a loan. It affords companies the best chance at getting the working capital needed to survive, move forward, and be prepared to grow again as the economy comes to life and recovers. Lenders see a highly rated insurance company standing behind the borrower as the deciding factor in approving the loan. These are tough times that require tough decisions by business leaders who are making every effort and taking every action necessary to insure the continuing viability of their businesses.

Performance Guarantee Insurance is coverage that guarantees the borrower's repayment of a loan. It affords companies the best chance at getting the working capital needed to survive, move forward, and be prepared to grow again as the economy comes to life and recovers. Lenders see a highly rated insurance company standing behind the borrower as the deciding factor in approving the loan. These are tough times that require tough decisions by business leaders who are making every effort and taking every action necessary to insure the continuing viability of their businesses.

Unprecedented Times

The economic activity of the U.S. continues to plummet during the corona virus pandemic. Unemployment is soaring because of stay at home orders, social distancing policies and disruptions in supply chains due to outbreaks at critical production facilities. As a result, the US economy has shed 33.5 million jobs through May 7. This is not a typical “black swan” event with the depth and speed of the economic decline exceeding that of the Great Depression.

To put the economic impact in perspective, at the beginning of March 2020, the unemployment rate was 4.4% - what many economists consider a natural rate of unemployment. Now, that "real" rate has blown up to 24.7% unemployment and we are facing the reality that unemployment could rise above the Great Depression high of 24.9% to 30%, according to reports from the Federal Reserve Bank of St. Louis, with a contraction of GDP exceeding 38%. This impact would be worse than the Great Depression since unemployment is a lagging indicator of economic activity. Employers resist hiring new employees until there is confidence the economy will rebound and stay strong. It’s clear businesses are looking at continued suffering. The need for additional working capital will continue to increase as the depth of the economic downturn deepens and the recovery is prolonged.

To put the economic impact in perspective, at the beginning of March 2020, the unemployment rate was 4.4% - what many economists consider a natural rate of unemployment. Now, that "real" rate has blown up to 24.7% unemployment and we are facing the reality that unemployment could rise above the Great Depression high of 24.9% to 30%, according to reports from the Federal Reserve Bank of St. Louis, with a contraction of GDP exceeding 38%. This impact would be worse than the Great Depression since unemployment is a lagging indicator of economic activity. Employers resist hiring new employees until there is confidence the economy will rebound and stay strong. It’s clear businesses are looking at continued suffering. The need for additional working capital will continue to increase as the depth of the economic downturn deepens and the recovery is prolonged.

Long Recovery

Businesses are suffering unprecedented declines in revenue while at the same time the risk to their operations’ long-term viability grows. The risks for the economic recovery are severe, with many economists indicating the recovery is likely to be a long and grueling process that could take three or more years with severe ups and downs along the way.

As businesses struggle to survive the current shock, they need immediate cash in the form of loans and refinanced debt. Of critical importance to both the borrowing company and the lender is the risk of repayment. Naturally, in this climate, the higher the probability of default on a loan may result in no loan at all. Even if loans are considered, they may come with terms too costly for the borrower.

The little-known secret of Performance Guarantee Insurance reduces the repayment risk for the borrower and the lender. As a result, the likelihood a loan will be approved is greatly increased. Of course, it remains a tough decision for a business to take on new debt or refinance its existing debt.

As businesses struggle to survive the current shock, they need immediate cash in the form of loans and refinanced debt. Of critical importance to both the borrowing company and the lender is the risk of repayment. Naturally, in this climate, the higher the probability of default on a loan may result in no loan at all. Even if loans are considered, they may come with terms too costly for the borrower.

The little-known secret of Performance Guarantee Insurance reduces the repayment risk for the borrower and the lender. As a result, the likelihood a loan will be approved is greatly increased. Of course, it remains a tough decision for a business to take on new debt or refinance its existing debt.

Tough Times Require Tough Choices

Businesses in every industry are making tough decisions warranted by a crisis of the magnitude that COVID-19 represents. It started with furloughs and pay cuts, but every aspect of operational costs is being analyzed for possible savings, all with a focus on understanding how much cash the business will need and for how long. This is only part of the equation. All businesses need to ensure their financing remains viable. The process requires scenario based planning and a critical self-assessment of a business’s ability to service the debt.

Debt refinancing is a critical step in the cash flow analysis process. It can strengthen net positive cash flow and slow the burn rate to buy critical time until a recovery begins. Refinancing is a simple concept to pay down remaining debt from a loan with proceeds of a new loan with better terms, including more money for working capital, longer repayment terms, lower rates, and less frequent payments.

However, the financial analysis of whether to refinance or not is more complex as the lower payments may come with a lot of potential negatives. Debt refinancing means paying interest on interest. Prepayment penalties may be triggered. Refinancing short-term debt with other short-term debt can get very expensive creating a cash flow cycle from which a company cannot successfully emerge.

The decision to take on additional debt may seem simple on its face, balanced against the need for working capital in the midst of a sudden downturn in revenues. Again, the simple is not so obvious when considering the ability to repay the new loan must consider various projected cash flow models from optimistic to worst case scenario.

All of these factors pit a borrower’s hunger for funds and repayment risk profile against the lender's risk tolerance appetite. What’s needed is a financial structure that transfers the repayment risk, improves the risk profile for the borrower and increases the risk appetite for the lender. Performance Guarantee Insurance satisfies the needs of both the borrower and lender with an insurance contract guarantee for the repayment of the loan. The use of insurance allows a contractual structure, backed by a highly rated insurance company, that is familiar to business operators and lenders.

Debt refinancing is a critical step in the cash flow analysis process. It can strengthen net positive cash flow and slow the burn rate to buy critical time until a recovery begins. Refinancing is a simple concept to pay down remaining debt from a loan with proceeds of a new loan with better terms, including more money for working capital, longer repayment terms, lower rates, and less frequent payments.

However, the financial analysis of whether to refinance or not is more complex as the lower payments may come with a lot of potential negatives. Debt refinancing means paying interest on interest. Prepayment penalties may be triggered. Refinancing short-term debt with other short-term debt can get very expensive creating a cash flow cycle from which a company cannot successfully emerge.

The decision to take on additional debt may seem simple on its face, balanced against the need for working capital in the midst of a sudden downturn in revenues. Again, the simple is not so obvious when considering the ability to repay the new loan must consider various projected cash flow models from optimistic to worst case scenario.

All of these factors pit a borrower’s hunger for funds and repayment risk profile against the lender's risk tolerance appetite. What’s needed is a financial structure that transfers the repayment risk, improves the risk profile for the borrower and increases the risk appetite for the lender. Performance Guarantee Insurance satisfies the needs of both the borrower and lender with an insurance contract guarantee for the repayment of the loan. The use of insurance allows a contractual structure, backed by a highly rated insurance company, that is familiar to business operators and lenders.

Insurance Transfers Risk

Risk transfer using insurance is an integral component to an effective risk management plan. Insurance, at its core, is about transferring a defined risk of loss from one party to another in exchange for a premium. The premium represents the cost to cover the risk associated with a contractual obligation to pay a benefit in the event the defined risk occurs. In the case of life insurance, the premium an individual pays covers the costs of the insurance company having to pay a benefit in the event of death.

The costs of coverage for any risk require people called actuaries, who work for insurance companies to determine the risks associated with a policy. They look at how likely an event like death, disaster or an accident is, and the likelihood of a claim being filed, as well as how much the company will be on the hook for paying out if a claim is filed. They put this information into a chart called an actuary table and give this to a person called an underwriter. Now, the underwriter uses this data along with information provided by the person or company asking for insurance when they issue a policy to determine what the exact premium will be for coverage they want.

The costs of coverage for any risk require people called actuaries, who work for insurance companies to determine the risks associated with a policy. They look at how likely an event like death, disaster or an accident is, and the likelihood of a claim being filed, as well as how much the company will be on the hook for paying out if a claim is filed. They put this information into a chart called an actuary table and give this to a person called an underwriter. Now, the underwriter uses this data along with information provided by the person or company asking for insurance when they issue a policy to determine what the exact premium will be for coverage they want.

Insuring The Loan Repayment

Almost any risk can be quantified by insurance actuaries, including the risk that a borrower will default on a loan over a given time period due to a lack of revenue. Numerous factors are considered when actuaries quantify the risk of a borrower defaulting on a loan. Some of these are the macroeconomic conditions, specific borrower strengths, weaknesses, opportunities, and threats, current industry conditions, operational risks, revenue risks, current asset valuation and supply chain risks. Today, the duration of the pandemic with possible ebbs and flows over time are a new factor.

The actuaries consider all these factors to create an actuary table indicating how likely it is that a borrower will default on a loan and how much the insurance company will have to pay if a claim is filed. The underwriters use the actuary table along with additional information on the company and/or the individual owners of the company to determine what the exact one-time premium will be to insure the repayment of the loan i nth event the borrower defaults. The total loss guarantee on the loan is straightforward to measure based on the loan principal, interest, and penalties in the event of a default at a given time in the life of the loan.

Naturally, the insurance is only as good as the strength of the company standing behind the promise to repay the loan, as indicated by their credit rating.

The actuaries consider all these factors to create an actuary table indicating how likely it is that a borrower will default on a loan and how much the insurance company will have to pay if a claim is filed. The underwriters use the actuary table along with additional information on the company and/or the individual owners of the company to determine what the exact one-time premium will be to insure the repayment of the loan i nth event the borrower defaults. The total loss guarantee on the loan is straightforward to measure based on the loan principal, interest, and penalties in the event of a default at a given time in the life of the loan.

Naturally, the insurance is only as good as the strength of the company standing behind the promise to repay the loan, as indicated by their credit rating.

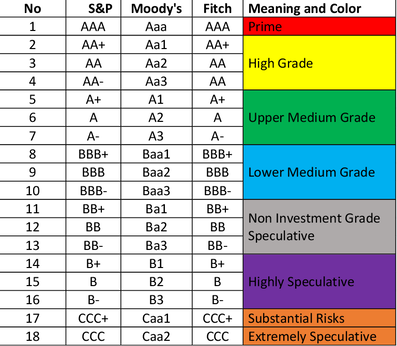

The Promise Behind Insurance

| An insurance company credit rating is the opinion of an independent agency regarding the insurance company's solvency, financial strength, and ability to pay policyholder claims. There are four major insurance company rating agencies: Moody’s, A.M. Best, Fitch, and Standard & Poor’s (the last two companies also provide corporate credit ratings for investors). Each agency has its own rating scale that doesn’t necessarily equate to another company’s rating scale, even when the ratings appear similar. |

Borrowers and lenders relying on the promise of an insurance company to pay off a loan in the event of a default will prefer, or even demand, an insurance company with an investment grade rating to issue the Performance Guarantee Insurance. An investment grade rating provides the assurance that the insurance company will be able to meet its obligation to pay the benefit in the event the borrower defaults on the loan. As an example, an insurance company with an S&P Global rating of 'AAA' has the highest rating assigned by S&P Global Ratings. The obligor's capacity to meet its financial commitments on the obligation is extremely strong. An insurance company rated 'AA' differs from the highest-rated AAA only to a small degree. The obligor's capacity to meet its financial commitments on the obligation is very strong.

In the case of Performance Guarantee Insurance, the issuing insurance company has a 'AA' S & P Global Ratings which indicates the insurance company's solvency, financial strength, and ability to pay policyholder claims is very strong. The borrowers and lenders can be confident the loan will be repaid because of the capacity and willingness of the insurance company to meet its financial commitments on the Performance Guarantee Insurance in accordance with the terms of the insurance contract in the event of a default.

In the case of Performance Guarantee Insurance, the issuing insurance company has a 'AA' S & P Global Ratings which indicates the insurance company's solvency, financial strength, and ability to pay policyholder claims is very strong. The borrowers and lenders can be confident the loan will be repaid because of the capacity and willingness of the insurance company to meet its financial commitments on the Performance Guarantee Insurance in accordance with the terms of the insurance contract in the event of a default.

Best Odds For A Loan Approval

Shifting the risk that cash flow will not be sufficient to repay a loan from the borrower to an AA rated insurance company is a powerful tool to improving the odds of a loan getting approved. The risk profile of the borrower is drastically improved based on the investment grade guarantee behind the borrower’s performance. The back stop of the insurance creates the financial strength of a stabilized projected revenue stream and a balance sheet protection. The final result is improved credit worthiness and an attractive loan for the lender. In fact, the financial impact of Performance Guarantee Insurance may allow a company to obtain their own investment grade rating of BBB or better. An investment grade rating is especially important for companies seeking to offer their own debt for sale in the form of bonds.

Lenders, as the beneficiaries to the coverage, mitigate their downside risks associated with potential poor financial performance for their existing and future loan portfolios. A lower risk profile often results in better loan terms that are more cash flow efficient for the borrower further strengthening the outlook on the borrower’s performance long term.

Lenders, as the beneficiaries to the coverage, mitigate their downside risks associated with potential poor financial performance for their existing and future loan portfolios. A lower risk profile often results in better loan terms that are more cash flow efficient for the borrower further strengthening the outlook on the borrower’s performance long term.

Bottom Line

There’s great uncertainty about jobs and the economy, about the federal SBA and PPP loans, and about reopening businesses and the potential for closing them again later in the year. Performance Guarantee Insurance enables both small and large businesses to engage lenders and acquire much needed cash. The insurance increases the likelihood of borrowing success by improving the creditworthiness of the borrower thereby reducing the risk for lenders. This is a great message to send to internal and external stakeholders, as well as lenders who want to help businesses survive these unprecedented times.

Disclaimer: Critical Mission Consulting, LLC is providing Performance Guarantee Insurance to its customers.

Back to Blog

Read More

The economy is starting to open and business leaders need to plan their rehire policies. I crafted a rehire policy that addresses many of the issues that must be addressed when bringing back a terminated or furloughed employee. I am also making a recall letter template available which outlines the formal communication advising an employee that they are being invited to return to work.

RSS Feed

RSS Feed