TJ Agresti, JD, LLM, CAMFounder and President Archives

February 2021

|

Back to Blog

Business Finance | 9 MIN Read Loan Repayment Insurance Is The SecretThe ability of a business to borrow money will make the difference between surviving or failing during the current crisis and being ready to thrive when the economy recovers. Many business leaders are asking their advisors for guidance on how to improve their odds of successfully obtaining a loan. At the same time, lenders are looking at the economic landscape trying to navigate a level of unprecedented uncertainty which is creating barriers to lending. A new lending product has emerged to provide both lender and borrower assurance that a loan will be repaid during these uncertain times. It’s called Performance Guarantee Insurance. Performance Guarantee Insurance is coverage that guarantees the borrower's repayment of a loan. It affords companies the best chance at getting the working capital needed to survive, move forward, and be prepared to grow again as the economy comes to life and recovers. Lenders see a highly rated insurance company standing behind the borrower as the deciding factor in approving the loan. These are tough times that require tough decisions by business leaders who are making every effort and taking every action necessary to insure the continuing viability of their businesses. Unprecedented TimesThe economic activity of the U.S. continues to plummet during the corona virus pandemic. Unemployment is soaring because of stay at home orders, social distancing policies and disruptions in supply chains due to outbreaks at critical production facilities. As a result, the US economy has shed 33.5 million jobs through May 7. This is not a typical “black swan” event with the depth and speed of the economic decline exceeding that of the Great Depression. To put the economic impact in perspective, at the beginning of March 2020, the unemployment rate was 4.4% - what many economists consider a natural rate of unemployment. Now, that "real" rate has blown up to 24.7% unemployment and we are facing the reality that unemployment could rise above the Great Depression high of 24.9% to 30%, according to reports from the Federal Reserve Bank of St. Louis, with a contraction of GDP exceeding 38%. This impact would be worse than the Great Depression since unemployment is a lagging indicator of economic activity. Employers resist hiring new employees until there is confidence the economy will rebound and stay strong. It’s clear businesses are looking at continued suffering. The need for additional working capital will continue to increase as the depth of the economic downturn deepens and the recovery is prolonged. Long RecoveryBusinesses are suffering unprecedented declines in revenue while at the same time the risk to their operations’ long-term viability grows. The risks for the economic recovery are severe, with many economists indicating the recovery is likely to be a long and grueling process that could take three or more years with severe ups and downs along the way. As businesses struggle to survive the current shock, they need immediate cash in the form of loans and refinanced debt. Of critical importance to both the borrowing company and the lender is the risk of repayment. Naturally, in this climate, the higher the probability of default on a loan may result in no loan at all. Even if loans are considered, they may come with terms too costly for the borrower. The little-known secret of Performance Guarantee Insurance reduces the repayment risk for the borrower and the lender. As a result, the likelihood a loan will be approved is greatly increased. Of course, it remains a tough decision for a business to take on new debt or refinance its existing debt. Tough Times Require Tough ChoicesBusinesses in every industry are making tough decisions warranted by a crisis of the magnitude that COVID-19 represents. It started with furloughs and pay cuts, but every aspect of operational costs is being analyzed for possible savings, all with a focus on understanding how much cash the business will need and for how long. This is only part of the equation. All businesses need to ensure their financing remains viable. The process requires scenario based planning and a critical self-assessment of a business’s ability to service the debt. Debt refinancing is a critical step in the cash flow analysis process. It can strengthen net positive cash flow and slow the burn rate to buy critical time until a recovery begins. Refinancing is a simple concept to pay down remaining debt from a loan with proceeds of a new loan with better terms, including more money for working capital, longer repayment terms, lower rates, and less frequent payments. However, the financial analysis of whether to refinance or not is more complex as the lower payments may come with a lot of potential negatives. Debt refinancing means paying interest on interest. Prepayment penalties may be triggered. Refinancing short-term debt with other short-term debt can get very expensive creating a cash flow cycle from which a company cannot successfully emerge. The decision to take on additional debt may seem simple on its face, balanced against the need for working capital in the midst of a sudden downturn in revenues. Again, the simple is not so obvious when considering the ability to repay the new loan must consider various projected cash flow models from optimistic to worst case scenario. All of these factors pit a borrower’s hunger for funds and repayment risk profile against the lender's risk tolerance appetite. What’s needed is a financial structure that transfers the repayment risk, improves the risk profile for the borrower and increases the risk appetite for the lender. Performance Guarantee Insurance satisfies the needs of both the borrower and lender with an insurance contract guarantee for the repayment of the loan. The use of insurance allows a contractual structure, backed by a highly rated insurance company, that is familiar to business operators and lenders. Insurance Transfers RiskRisk transfer using insurance is an integral component to an effective risk management plan. Insurance, at its core, is about transferring a defined risk of loss from one party to another in exchange for a premium. The premium represents the cost to cover the risk associated with a contractual obligation to pay a benefit in the event the defined risk occurs. In the case of life insurance, the premium an individual pays covers the costs of the insurance company having to pay a benefit in the event of death. The costs of coverage for any risk require people called actuaries, who work for insurance companies to determine the risks associated with a policy. They look at how likely an event like death, disaster or an accident is, and the likelihood of a claim being filed, as well as how much the company will be on the hook for paying out if a claim is filed. They put this information into a chart called an actuary table and give this to a person called an underwriter. Now, the underwriter uses this data along with information provided by the person or company asking for insurance when they issue a policy to determine what the exact premium will be for coverage they want. Insuring The Loan RepaymentAlmost any risk can be quantified by insurance actuaries, including the risk that a borrower will default on a loan over a given time period due to a lack of revenue. Numerous factors are considered when actuaries quantify the risk of a borrower defaulting on a loan. Some of these are the macroeconomic conditions, specific borrower strengths, weaknesses, opportunities, and threats, current industry conditions, operational risks, revenue risks, current asset valuation and supply chain risks. Today, the duration of the pandemic with possible ebbs and flows over time are a new factor. The actuaries consider all these factors to create an actuary table indicating how likely it is that a borrower will default on a loan and how much the insurance company will have to pay if a claim is filed. The underwriters use the actuary table along with additional information on the company and/or the individual owners of the company to determine what the exact one-time premium will be to insure the repayment of the loan i nth event the borrower defaults. The total loss guarantee on the loan is straightforward to measure based on the loan principal, interest, and penalties in the event of a default at a given time in the life of the loan. Naturally, the insurance is only as good as the strength of the company standing behind the promise to repay the loan, as indicated by their credit rating. The Promise Behind Insurance

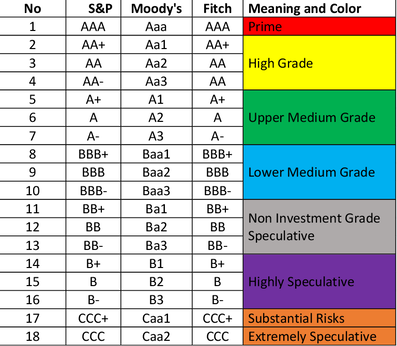

Borrowers and lenders relying on the promise of an insurance company to pay off a loan in the event of a default will prefer, or even demand, an insurance company with an investment grade rating to issue the Performance Guarantee Insurance. An investment grade rating provides the assurance that the insurance company will be able to meet its obligation to pay the benefit in the event the borrower defaults on the loan. As an example, an insurance company with an S&P Global rating of 'AAA' has the highest rating assigned by S&P Global Ratings. The obligor's capacity to meet its financial commitments on the obligation is extremely strong. An insurance company rated 'AA' differs from the highest-rated AAA only to a small degree. The obligor's capacity to meet its financial commitments on the obligation is very strong. In the case of Performance Guarantee Insurance, the issuing insurance company has a 'AA' S & P Global Ratings which indicates the insurance company's solvency, financial strength, and ability to pay policyholder claims is very strong. The borrowers and lenders can be confident the loan will be repaid because of the capacity and willingness of the insurance company to meet its financial commitments on the Performance Guarantee Insurance in accordance with the terms of the insurance contract in the event of a default. Best Odds For A Loan ApprovalShifting the risk that cash flow will not be sufficient to repay a loan from the borrower to an AA rated insurance company is a powerful tool to improving the odds of a loan getting approved. The risk profile of the borrower is drastically improved based on the investment grade guarantee behind the borrower’s performance. The back stop of the insurance creates the financial strength of a stabilized projected revenue stream and a balance sheet protection. The final result is improved credit worthiness and an attractive loan for the lender. In fact, the financial impact of Performance Guarantee Insurance may allow a company to obtain their own investment grade rating of BBB or better. An investment grade rating is especially important for companies seeking to offer their own debt for sale in the form of bonds. Lenders, as the beneficiaries to the coverage, mitigate their downside risks associated with potential poor financial performance for their existing and future loan portfolios. A lower risk profile often results in better loan terms that are more cash flow efficient for the borrower further strengthening the outlook on the borrower’s performance long term. Bottom LineThere’s great uncertainty about jobs and the economy, about the federal SBA and PPP loans, and about reopening businesses and the potential for closing them again later in the year. Performance Guarantee Insurance enables both small and large businesses to engage lenders and acquire much needed cash. The insurance increases the likelihood of borrowing success by improving the creditworthiness of the borrower thereby reducing the risk for lenders. This is a great message to send to internal and external stakeholders, as well as lenders who want to help businesses survive these unprecedented times. Disclaimer: Critical Mission Consulting, LLC is providing Performance Guarantee Insurance to its customers.

0 Comments

Read More

Leave a Reply. |

|

Privacy Policy

Cookies policy Terms of Use Disclaimers © 2013 - 2024 Critical Mission Consulting LLC All Rights reserved |

RSS Feed

RSS Feed