TJ Agresti, JD, LLM, CAMFounder and President Archives

February 2021

|

Back to Blog

6 Steps to PPP Loan Forgiveness6/16/2020 PPP Loan Forgiveness |

| The following expenses incurred or paid by the borrower during the 24 weeks following loan origination are eligible for forgiveness: Payroll Expenses:

Non-Payroll Expenses:

Note: For an independent contractor or sole proprietor, you must have claimed or be entitled to claim a deduction for these expenses on your 2019 Form 1040 Schedule C in order to claim them as expenses eligible for PPP loan forgiveness in 2020. |

- The time period to use funds is extended to 24 weeks from 8 weeks.

- The deadline to rehire workers is pushed back to December 31, 2020 (instead of June 30, 2020). The loan amount and salaries are still calculated using the original method.

- Additional exceptions have been added to the rehire requirements. If an employer can’t hire all employees back, the business can still receive forgiveness if it:

|

- The repayment term is extended to 5 years for new loans approved on or after June 5, 2020. In the event loans or portions of them are not forgiven, a business will now have five years at 1% interest to repay the loan. Further, the first payment will be deferred for six months after the SBA makes a determination on forgiveness.

- If you received a loan before June 5, contact your lender to see if you are able to extend your repayment term.

Filling Out the PPP

Loan Forgiveness Form

The following steps correspond to the PPP Loan Forgiveness Form.

Step 1: Determine total payroll costs in the 8 or 24 week covered period

Note: Ask your accountant, tax preparer or loan advisor about the wage limit of $15,385.00 for each employee

Add the total cash wages paid to all employees(limited to $15,385.00) and then add in:

a. Employer pension contribution

b. Employer health insurance premiums paid

c. Employer paid state and local taxes assessed on compensation

Step 2: Take the total from Step 1 and divide by .60

This determines the maximum amount of the PPP loan that will be forgiven.

Compare the amount of hte PPP loan received with the maximum amount that will be forgiven.

If the maximum amount under the 60% test is equal to or greater than the PPP loan, there is no reduction.

If the maximum amount under hte 60% test is less than the PPP loan, the difference will not be forgiven and will have to be repaid.

Step 3: determine eligible non-payroll costs

Add the total rent, interest, and utilities paid in the 8 or 24 week covered period

take the maximum a mount of hte PPP loan that can be forgiven, From Step 2, and multiply that by .40.

Compare the total of rent, interest, and utilities that were paid in the 8 or 24 week period to determine if the total is at least 40% of hte maximum PPP loan amount that is eligible for forgiveness.

If the total rent, interest, and utilities exceeds 40%, limit the amount that will be transferred to the form to 40%. This is the Step 3 total.

If the total rent, interest and utilities is less than 40% of hte maximum PPP loan amount that is eligible for forgiveness, enter the total on the form. This will increase the amount of hte PPP loan that will have to be repaid. This is the Step 3 total

Step: 4 Add the amounts determines in Step 2 and Step 3.

This is the total amount for Step 4:

Step 2 max amount of PPP loan eligible for forgiveness

Plus

Step 3 Non-payroll costs maxed at 40%

Equals

Steps 4 Total

Step 5: Determine if there was a salary reduction

a. For each employee, determine if their salary or wages were reduced by more than 40% during the covered period as compared to the salary or wages that were received during hte period of January 1, 2020 to March 31, 2020.

b. Do not include any employee whose wages were reduced due to a reduction in full-time employment. If an employee previously worked as a full-time employee and their hours were reduced by half, the reduction of salary or wages by more than 25% does not apply. (This reduction is taken into account in Step 6.)

c. For each employee, take 75% of their regular wages in the period of January 1, 2020 to March 31, 2020, before the reduction in wages, and then subtract the wages paid in the covered period. This is the amount of reduction in wages for that employee.

d. Convert the amount of reduction in wages calculated in c. above to the 8 or 24 week covered period. For example, if the employee is paid monthly, multiply the monthly reduction by 12 to get the annual amount, divide by 52 to get the weekly amount and then multiply by 8 or 24. If the employee is paid weekly, simply multiply the weekly reduction by 8 or 24.

e. But there is a savings clause. There is no reduction in wages if the employee's average salary or wage amount paid between February 15, 2020 and April 26, 2020 is less than the wages or salary paid on February 15, 2020 and the reduction is salary or wages in the covered period is restored to the wages or salary amount as of June 30, 2020.

f. Add up the reductions for all employees determined in d. above for whom the savings clause in e. above does not apply.

g. The Step 5 amount is the Step 4 total less f., the total reduction for all employees.

Step 6. Determine if there was a reduction in full-time employees

a. Determine if you meet the savings clause on June 30. Compare full-time employees between February 15 and April 26, 2020 to the full-time employees on February 15, 2020. If the number of full time employees is restored by June 30, 2020, there is no reduction in full time employees and hte PPP loan amount eligible for forgiveness is hte amount determine in Step 5.

b. If you don't meet the safe harbor in a. above, determine the average full-time employees in the covered period and divide that by the average full-time employees in either the period of January 1 to February 29 or February 15 to June 30.

Then multiple that by the amount determined in Step 5. This is the amount of the PPP loan that is eligible to be forgiven.

Step 1: Determine total payroll costs in the 8 or 24 week covered period

Note: Ask your accountant, tax preparer or loan advisor about the wage limit of $15,385.00 for each employee

Add the total cash wages paid to all employees(limited to $15,385.00) and then add in:

a. Employer pension contribution

b. Employer health insurance premiums paid

c. Employer paid state and local taxes assessed on compensation

Step 2: Take the total from Step 1 and divide by .60

This determines the maximum amount of the PPP loan that will be forgiven.

Compare the amount of hte PPP loan received with the maximum amount that will be forgiven.

If the maximum amount under the 60% test is equal to or greater than the PPP loan, there is no reduction.

If the maximum amount under hte 60% test is less than the PPP loan, the difference will not be forgiven and will have to be repaid.

Step 3: determine eligible non-payroll costs

Add the total rent, interest, and utilities paid in the 8 or 24 week covered period

take the maximum a mount of hte PPP loan that can be forgiven, From Step 2, and multiply that by .40.

Compare the total of rent, interest, and utilities that were paid in the 8 or 24 week period to determine if the total is at least 40% of hte maximum PPP loan amount that is eligible for forgiveness.

If the total rent, interest, and utilities exceeds 40%, limit the amount that will be transferred to the form to 40%. This is the Step 3 total.

If the total rent, interest and utilities is less than 40% of hte maximum PPP loan amount that is eligible for forgiveness, enter the total on the form. This will increase the amount of hte PPP loan that will have to be repaid. This is the Step 3 total

Step: 4 Add the amounts determines in Step 2 and Step 3.

This is the total amount for Step 4:

Step 2 max amount of PPP loan eligible for forgiveness

Plus

Step 3 Non-payroll costs maxed at 40%

Equals

Steps 4 Total

Step 5: Determine if there was a salary reduction

a. For each employee, determine if their salary or wages were reduced by more than 40% during the covered period as compared to the salary or wages that were received during hte period of January 1, 2020 to March 31, 2020.

b. Do not include any employee whose wages were reduced due to a reduction in full-time employment. If an employee previously worked as a full-time employee and their hours were reduced by half, the reduction of salary or wages by more than 25% does not apply. (This reduction is taken into account in Step 6.)

c. For each employee, take 75% of their regular wages in the period of January 1, 2020 to March 31, 2020, before the reduction in wages, and then subtract the wages paid in the covered period. This is the amount of reduction in wages for that employee.

d. Convert the amount of reduction in wages calculated in c. above to the 8 or 24 week covered period. For example, if the employee is paid monthly, multiply the monthly reduction by 12 to get the annual amount, divide by 52 to get the weekly amount and then multiply by 8 or 24. If the employee is paid weekly, simply multiply the weekly reduction by 8 or 24.

e. But there is a savings clause. There is no reduction in wages if the employee's average salary or wage amount paid between February 15, 2020 and April 26, 2020 is less than the wages or salary paid on February 15, 2020 and the reduction is salary or wages in the covered period is restored to the wages or salary amount as of June 30, 2020.

f. Add up the reductions for all employees determined in d. above for whom the savings clause in e. above does not apply.

g. The Step 5 amount is the Step 4 total less f., the total reduction for all employees.

Step 6. Determine if there was a reduction in full-time employees

a. Determine if you meet the savings clause on June 30. Compare full-time employees between February 15 and April 26, 2020 to the full-time employees on February 15, 2020. If the number of full time employees is restored by June 30, 2020, there is no reduction in full time employees and hte PPP loan amount eligible for forgiveness is hte amount determine in Step 5.

b. If you don't meet the safe harbor in a. above, determine the average full-time employees in the covered period and divide that by the average full-time employees in either the period of January 1 to February 29 or February 15 to June 30.

Then multiple that by the amount determined in Step 5. This is the amount of the PPP loan that is eligible to be forgiven.

Simple? - Not So Much

We are helping clients navigate the uncertainty due to ever changing rules surrounding hte PPP loan program. Our accounting staff is prepared to answer your questions about your PPP loan and assist you in the submission of your forgiveness application.

0 Comments

Read More

Back to Blog

Read More

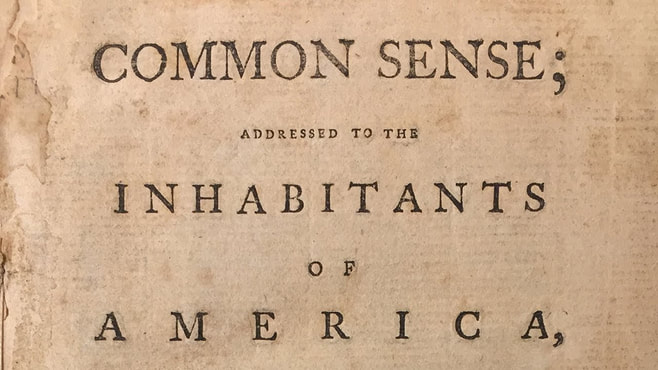

Maybe Common Sense Is Not Dead

6/4/2020

Business Finance | 3 Min read

Bi-Partisanship Is Not Dead Yet

In a stunning display of bi-partisanship, the Senate approved the House's Bill yesterday for a PPP Loan Program revision, called the Paycheck Protection Flexibility Act, which provides more flexibility to business and should ease businesses' burdens and concerns about utilizing the program. The Bill will now go to President Donald Trump, who is expected to sign it.

The revisions represent common sense fixes to a well intentioned business relief program that has been over burdened by confusion and recently underutilized by the very businesses it was intended to help through the crisis.

The revisions represent common sense fixes to a well intentioned business relief program that has been over burdened by confusion and recently underutilized by the very businesses it was intended to help through the crisis.

Summary Of PPP Loan Program Revisions

The Journal of Accountancy provides and excellent summary of the revisions compiled by AICPA:

- Current PPP borrowers can choose to extend the eight-week period to 24 weeks, or they can keep the original eight-week period. New PPP borrowers will have a 24-week covered period, but the covered period can’t extend beyond Dec. 31, 2020. This flexibility is designed to make it easier for more borrowers to reach full, or almost full, forgiveness.

- Under the language in the House bill, the payroll expenditure requirement drops to 60% from 75% but is now a cliff, meaning that borrowers must spend at least 60% on payroll or none of the loan will be forgiven. Currently, a borrower is required to reduce the amount eligible for forgiveness if less than 75% of eligible funds are used for payroll costs, but forgiveness isn’t eliminated if the 75% threshold isn’t met. Rep. Chip Roy (Texas), who co-sponsored the bill in the House, said in a House speech that the bill intended the sliding scale to remain in effect at 60%. Senators Marco Rubio and Susan Collins indicated that technical tweaks could be made to the bill to restore the sliding scale.

- Borrowers can use the 24-week period to restore their workforce levels and wages to the pre-pandemic levels required for full forgiveness. This must be done by Dec. 31, a change from the previous deadline of June 30.

- The legislation includes two new exceptions allowing borrowers to achieve full PPP loan forgiveness even if they don’t fully restore their workforce. Previous guidance already allowed borrowers to exclude from those calculations employees who turned down good faith offers to be rehired at the same hours and wages as before the pandemic. The new bill allows borrowers to adjust because they could not find qualified employees or were unable to restore business operations to Feb. 15, 2020, levels due to COVID-19 related operating restrictions.

- Borrowers now have five years to repay the loan instead of two. The interest rate remains at 1%.

- The bill allows businesses that took a PPP loan to also delay payment of their payroll taxes, which was prohibited under the CARES Act.

PPP Loan Program Background

The PPP Loan Program launched in early April with $349 billion in funding. I previously commented on the the initial demand exhausting available funds in less than two weeks as well Congress provided an additional $310 billion in funding in an April 21 vote. I also wrote about waning demand from business due to concerns about obtaining of loan forgiveness under the program’s rules advising our clients to wait and see how Congress addressed the uncertainty.

When dealing with the government, especially in this current atmosphere of dysfunction, a wait and see approach sometimes pays off. The current revisions from a common sense bi-partisan bill might actually fulfill the original intent of hte PPP Loan Program and help many struggling businesses survive the current crisis and keep paying their employees. A little hope is something we could all use right now.

When dealing with the government, especially in this current atmosphere of dysfunction, a wait and see approach sometimes pays off. The current revisions from a common sense bi-partisan bill might actually fulfill the original intent of hte PPP Loan Program and help many struggling businesses survive the current crisis and keep paying their employees. A little hope is something we could all use right now.

RSS Feed

RSS Feed